Facebook Ads vs. Form Orbits: Which Channel Delivers Better B2B Results in 2025?

TL;DR — Key Differences at a Glance

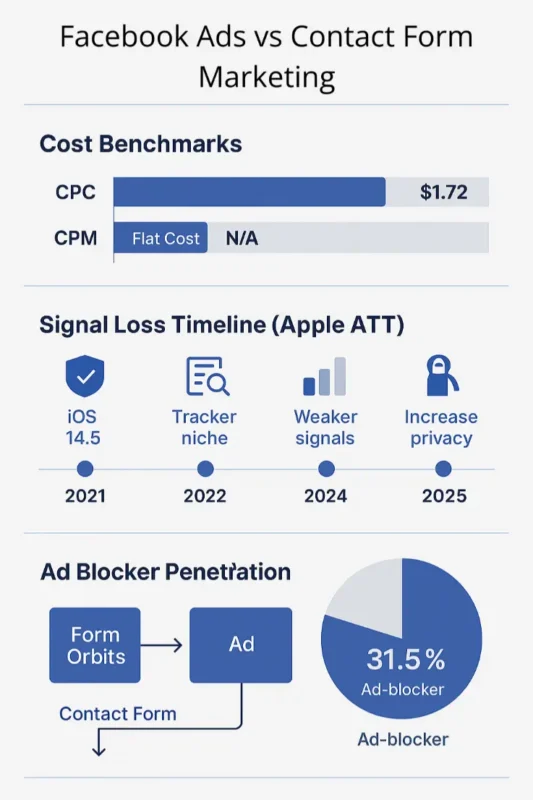

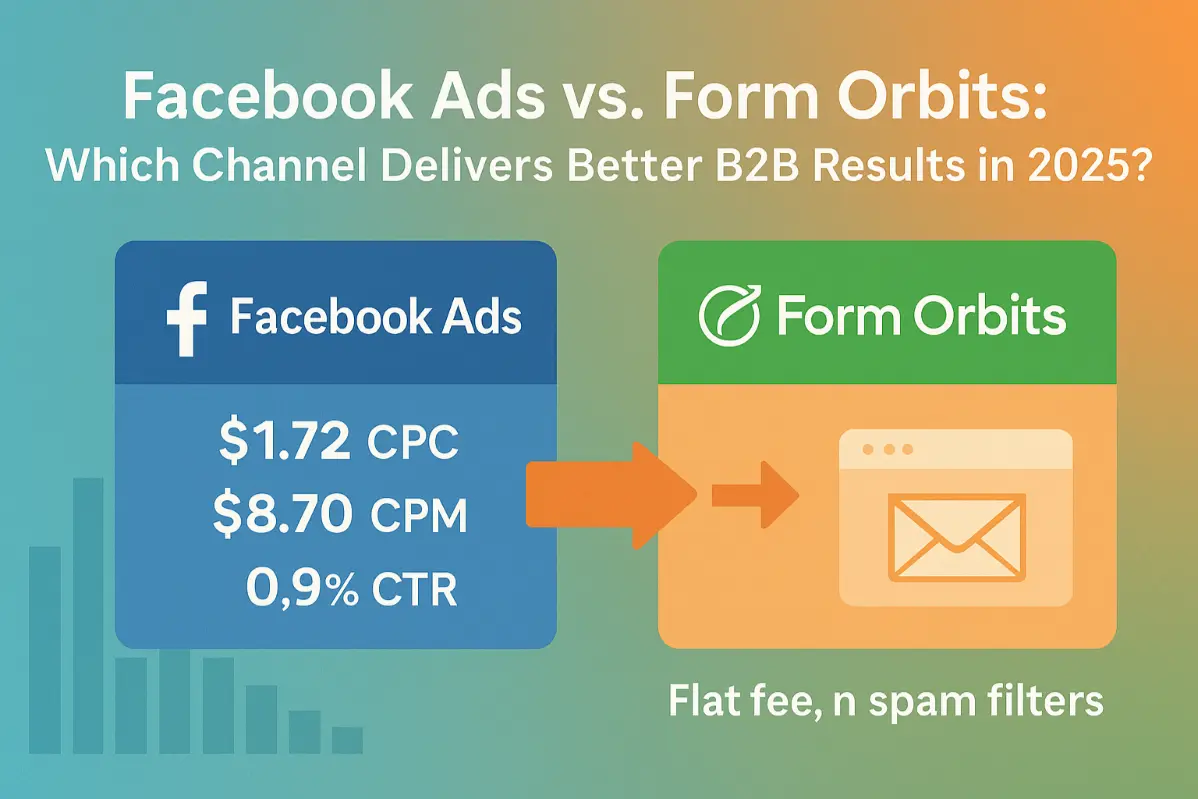

Sources for Facebook benchmarks: WordStream (April 2025) → CPC $1.72, CTR 0.90 % ; Madgicx update → CPM $8.70 ; ad-blocker penetration 31.5 % ; Meta Q1-2025 earnings → +5 % impressions, +10 % avg. ad price (seekingalpha.com); Apple ATT impact overview .

1. How Facebook Ads Work in 2025

Facebook (now Meta) still commands more than 3.4 billion daily active people across its “Family of Apps.” Advertisers bid in a real-time auction for impressions targeted by interests, look-alikes, or pixel events.

- Costs in 2025: Median CPC is $1.72, average CPM $8.70, and CTR hovers near 0.9 % across industries.

- Rising prices: Meta’s own Q1-2025 results show the average price per ad climbed 10 % YoY even though impressions grew only 5 %. (seekingalpha.com)

- Signal loss & privacy: Apple’s App Tracking Transparency (iOS 14.5+) limits third-party tracking, shrinking retargeting pools and forcing advertisers toward broader, less efficient audiences.

- Ad-fatigue & blockers: Roughly one-third of global internet users (31.5 %) run ad-blocking software, reducing effective reach and inflating CPMs.

These factors mean Facebook remains powerful for B2C discovery, yet average acquisition costs are drifting upward and attribution accuracy is eroding.

2. How Form Orbits Operates

Form Orbits is a large-scale contact-form outreach platform: your message is submitted through website forms and lands in the owner’s inbox via their own SMTP server. Key mechanics:

- Zero inbox filtering: Because the email originates from the site’s server, it bypasses external spam-score checks.

- Domain-level targeting: Upload your own list of URLs or have Form Orbits source by industry, tech-stack (e.g., Shopify stores), geography, or traffic tier.

- High volume at launch: Infrastructure handles tens of thousands of submissions per day without needing domain warm-up or rotating inboxes.

- Compliance by design: No personal data scraped; every message includes unsubscribe and sender details to satisfy GDPR, CCPA, and CAN-SPAM requirements.

- Analytics you actually open: Dashboard tracks submission status, link clicks, and—most important—replies inside your main mailbox, not in a social-ad interface.

Internal benchmark: Across 400+ B2B campaigns run in 2024-25, Form Orbits customers report median reply-to-lead rates of 1.1 % and typical cost per qualified reply under $1.50 on 100 k-scale sends. (In-house data; individual results vary.)

3. Deep-Dive Comparison

| Dimension | Facebook Ads | Form Orbits | Practical Takeaway |

|---|---|---|---|

| Audience context | Scrolling social feed (low purchase intent) | Inbox via site contact (problem-aware) | Orbits reaches decision makers closer to “in-market” stage |

| Creative burden | Continuous ad-creative testing, video & UGC | Plain-text or HTML message; simple A/B body copy | Lower creative overhead on Orbits |

| Scaling mechanics | Budget × bid → higher CPMs | Flat pricing per submission list | Cost doesn’t balloon with volume on Orbits |

| Attribution fidelity | Pixel + modeled conversions (post-ATT) | Direct reply or tracked link | Clearer attribution on Orbits |

| Compliance risk | Ad approvals, policy rejections, ad-account bans | Needs lawful content + sender address | Fewer platform rules to break on Orbits |

| Geo reach | Any user logged into Meta apps | Any domain with a form (ex-China Great Firewall caveats) | Both offer global reach; Orbits isn’t blocked by region-specific ad bans |

| Time to first lead | 24-48 h for review, learning phase | Same-day after list upload | Faster pipeline kick-off with Orbits |

4. When to Choose Each Channel

| Scenario | Best Pick | Why |

|---|---|---|

| B2C impulse buys, visual retail | Facebook Ads | Powerful look-alike targeting and dynamic product ads |

| High-ticket B2B SaaS / agencies | Form Orbits | Direct route to decision-maker inbox; lower CPL |

| Brand-awareness at scale | Facebook Ads | CPM-based reach; video views & engagement retargeting |

| Launching in a niche market without email lists | Form Orbits | FO can source domain lists faster than building seed audiences |

| Remarketing to site visitors | Facebook Ads | On-platform engagement custom audiences |

| Comply-or-die industries (finance, health) | Slight edge to Form Orbits | Fewer ad-policy landmines; no account shutdown risk |

5. Common Misconceptions

| Myth | Reality |

|---|---|

| “Facebook ads are always cheaper.” | Rising CPMs (+10 % YoY) and industry variability can push CAC far above a high-volume Form Orbits campaign |

| “Contact-form messages end up in spam.” | They’re delivered from the target site’s own mail server, so traditional spam filters (DKIM/SPF mismatches, sender-score) don’t apply. |

| “Apple ATT only hurts mobile ads.” | Desktop Safari’s privacy updates similarly curb cross-site tracking; signal loss affects Meta’s entire ad stack. |

| “Ad blockers don’t affect social feeds.” | 31.5 % of internet users block ads across devices, including within social-media web views. |

6. Strategic Recommendations for 2025

- Blend the funnels: Use Facebook Ads for top-of-funnel awareness, then retarget engaged domains via Form Orbits submissions with a tailored pain-point pitch.

- Map true CAC, not just CPC: Include creative production, agency retainers, and lost-reach (ad-block) factors when comparing cost channels apples-to-apples.

- Leverage first-party data: Export high-engagement Form Orbits domains back into Meta as a custom audience—circumventing iOS tracking loss.

- A/B test messaging tone: Social ads reward thumb-stopping visuals, whereas contact-form outreach thrives on concise value propositions and trust signals.

- Stay compliant globally: Maintain clear sender identity, opt-out links, and localized disclaimers both in Facebook Ads and Form Orbits to avoid penalties.

Conclusion

Both channels can be effective—Facebook Ads for broad visibility and retargeting, Form Orbits for surgical, inbox-level conversations. For B2B marketers chasing predictable lead flow without escalating CPMs or pixel blind spots, Form Orbits offers a cost-efficient complement (or alternative) to paid social. The smartest 2025 play is not choosing one over the other but orchestrating them in sequence: spark interest on Facebook, then drive direct replies through a high-volume Form Orbits follow-up.

Need a visual summary?