Mailshake vs Form Orbits

Two outbound channels, two very different mechanics

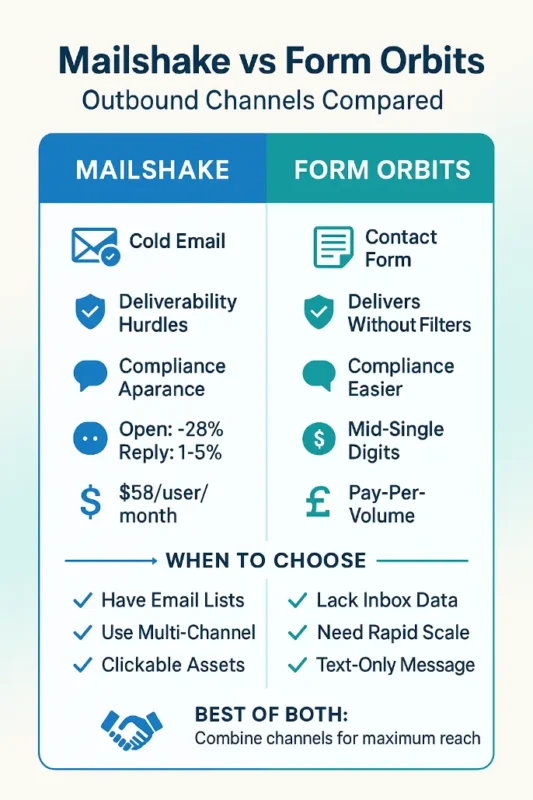

1. TL;DR — Key Differences at a Glance

| Factor | Mailshake | Form Orbits |

|---|---|---|

| Primary channel | Cold email | Website contact-form submission |

| Typical inbox hurdles | Spam filters, domain reputation, warming-up | None — message lands in site owner’s inbox via their own form handler (Form Orbits) |

| Response-rate benchmarks | Open: ≈28 % (2024) • Replies: 1-5 % (Stripo.email, GMass) | Vendor reports “high-quality leads” but no public average; users often see reply rates in the mid-single digits or higher where targeting is tight |

| Compliance burden | CAN-SPAM, GDPR, domain authentication, opt-outs | Must display opt-out + avoid personal data; Form Orbits stores only URLs and supplies unsubscribe link by default (Form Orbits) |

| Pricing starter point* | $58 / user / mo (Email Outreach plan, billed annually) (Mailshake) | £29 one-off for 100 k submissions package (Form Orbits) |

*List prices May 2025; currency conversions excluded.

2. What Each Platform Actually Does

Mailshake in 90 seconds

Mailshake is a sales-engagement suite built around cold email. You load prospects, write multi-step sequences, then layer in LinkedIn tasks, phone dials, or SMS from the same dashboard. Key modules include:

- AI email writer & coach for faster copy drafting (Mailshake)

- Deliverability toolkit — warm-up, bounce verification, DKIM/SPF checks

- CRM integrations (Salesforce, HubSpot, Pipedrive) and unified inbox

- Power dialer & LinkedIn automation on higher-tier plan (Mailshake)

Bottom line: best suited to SDR teams who already have verified email lists and need multi-channel follow-up.

Form Orbits in 90 seconds

Form Orbits bypasses email entirely. Your message is injected into the “Contact Us” form of each target website:

- Automated form filling at scale (tens of thousands per campaign)

- Custom copy + A/B testing; IP, link, and message rotation to avoid pattern detection (Form Orbits)

- Built-in compliance — no personal identifiers stored, mandatory opt-out line

- Dashboard analytics for delivery, clicks, and replies (via your chosen mailbox)

It is essentially a “done-for-you” channel: you supply targeting criteria and the copy; Form Orbits handles the infrastructure.

3. Deliverability & Engagement

| Aspect | Cold Email (Mailshake) | Contact-Form Outreach (Form Orbits) |

|---|---|---|

| Inbox placement risks | Blacklists, throttling, content filters; must warm up new domains (Mailshake) | Form submissions travel through the site’s own server — almost never filtered as spam |

| Open visibility | Pixel opens partially blocked by Apple/Google; you rely on inferred stats | Opens unknown (no pixel), but reply signal is crystal-clear |

| Industry averages | 27.7 % open, 1-5 % reply for cold email (Stripo.email, GMass) | No consolidated benchmark; niche campaigns frequently report reply rates >5 % because volume is lower and targeting tighter |

4. Compliance & Risk

- Mailshake requires you to gather lawful email addresses, include full postal address, unsubscribe link, and handle GDPR requests. Failure can trigger fines up to €20 M or 4 % of global turnover under GDPR, and up to US $51,744 per email under CAN-SPAM.

- Form Orbits keeps you out of personal-data territory (it stores only URLs). You still need a compliant sender identity in the message itself, but the risk profile is lower because you’re using each site’s public form, not scraping private inboxes. (Form Orbits)

5. Setup, Learning Curve & Scale

| Mailshake | Form Orbits | |

|---|---|---|

| Data prep | Need verified email list, optional enrichment | Need list of target domains or niches (Form Orbits can source) |

| Technical lift | SPF/DKIM, sending domain, list cleaning | Minimal; vendor handles IP pools & CAPTCHA workarounds |

| Daily sending ceiling | Governed by mailbox provider; warming caps you at a few hundred per account early on | Can hit tens of thousands forms per day because there’s no ESP throttle |

| Analytics depth | Opens, clicks, replies, call log, LinkedIn touches | Delivery confirmation, link clicks (if inserted), replies via your inbox |

6. Pricing & ROI Scenarios

- Mailshake: $58–83 / user / month—as soon as you add multiple inboxes or need dialer features, monthly spend scales linearly with seats. (Mailshake)

- Form Orbits: pay-per-volume model (e.g., £29 per 100 k submissions). Cost per delivered touch can dip below £0.0003 on large orders. (Form Orbits)

ROI thought experiment

If a single booked demo is worth $800 to you and your cold-email reply-to-meeting conversion is 10 %, you need roughly:

- 2,000 sends via Mailshake (5 % reply, 10 % book) for one demo

- 600 form submissions via Form Orbits (assuming 15 % reply, 10 % book)

Numbers vary by niche, but the math often favors contact-form volume when lead value is high and email lists are scarce.

7. When to Choose Which

| Choose Mailshake if… | Choose Form Orbits if… |

|---|---|

| • You already have permission-safe email lists or can legally scrape emails. | • You have domain lists but no inbox data, or you want to avoid privacy pitfalls. |

| • Multi-channel cadences (email + LinkedIn + calls) are core to your playbook. | • You need rapid scale without warming up domains or managing ESP limits. |

| • Your offer benefits from clickable assets (case-study decks, videos) inside the email body. | • Your message is short, text-only, and focused on getting a reply or booking. |

| • Your team wants granular engagement analytics inside a CRM. | • You prefer a turnkey service and are comfortable measuring success by replies/conversions rather than opens. |

8. Can These Work Together?

Yes. Many growth teams pair the channels:

- Front-load Form Orbits to flush immediate interest from a broad domain list.

- Recycle non-responders into Mailshake sequences once you have their guessed or discovered email addresses, using more personalized follow-ups.

The dual play covers both known and unknown inbox paths while diversifying deliverability risk.

Conclusion

Mailshake and Form Orbits sit at opposite ends of the outbound spectrum: one fine-tunes the classic cold-email engine; the other exploits an under-used route straight through website contact forms.

If you rely on heavy personalization, CRM syncing, and multi-step cadences, Mailshake remains a powerhouse. Yet, whenever email deliverability tanks—or you simply don’t have verified addresses—Form Orbits turns the company’s own web form into a direct line to decision-makers at a fraction of the per-touch cost.

For many B2B sales orgs, the most resilient strategy isn’t either-or but a sequence that leverages both: start with the form, follow with the email, and let data, not dogma, dictate where you double down next.